Tax specialist

About BYD

Our Purpose is to build a zero-emission future that reconnects humanity with nature. We are looking for talent that connects with this mission and want to create positive impact by joining a diverse and dynamic team.

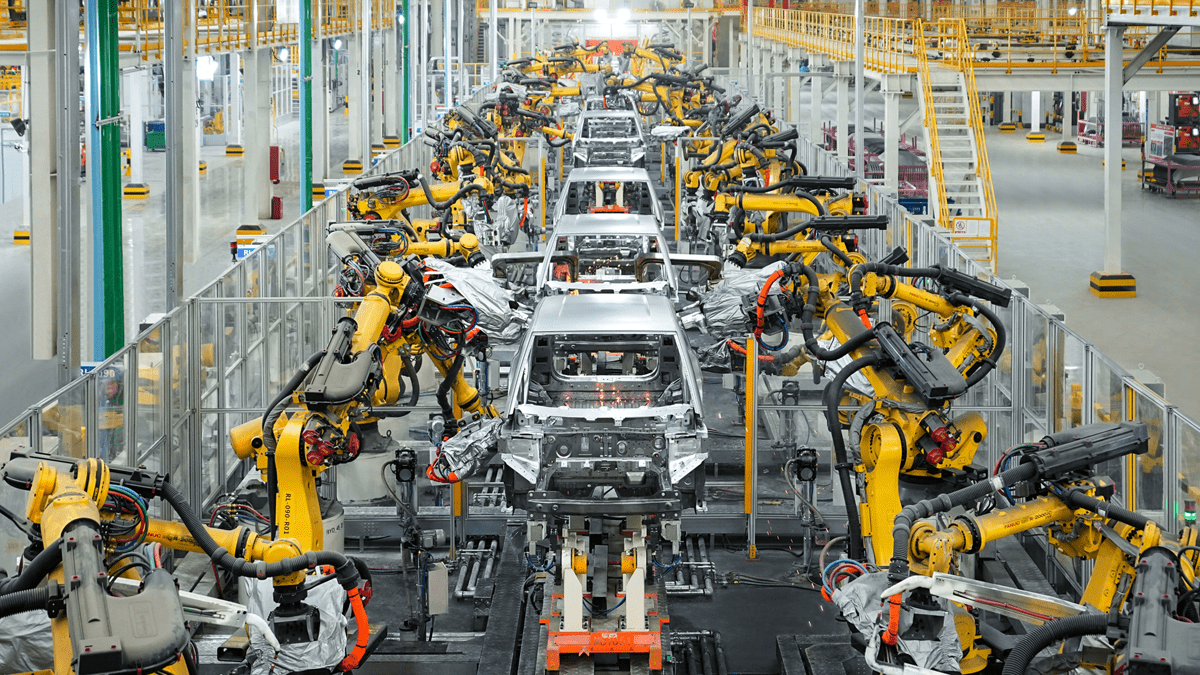

BYD is a leading, high-tech multinational, based in Shenzhen, China. Operates in four core fields of IT, automotive, new energy, and rail transit and employs over 300,000 people worldwide. As a global pioneer in New Energy Solutions BYD is dedicated to building a zero-emission ecosystem.

About BYD Europe Holding

Based in Budapest, Hungary, BYD Europe Holding operates its European headquarters and R&D centre, supporting sales, after-sales services, vehicle testing, and certification across Europe. The site plays an important role in localized vehicle development and innovation for European customers.

BYD Europe Holding is looking for Tax specialist to our Finance Division in Budapest.

Key Responsibilities:

Overseeing the end-to-end review and timely filing of Hungarian indirect tax compliance matters VAT return, EC Sales Lists and Intrastat Reports;

Liaising with the tax authorities during tax audits and inquiries, handling notifications from the authorities.

Coordinating with external tax advisors and auditors to ensure smooth statutory reporting processes.

Performing regular reconciliations between the General Ledger (GL), analytics and tax authority (NAV) records.

Monitoring and governing the NAV Online Invoice reporting data to ensure 100% accuracy and system synchronization.

Coordinating and arranging administrative tasks such as obtaining tax residency certificates, VAT registrations, official permits and other tax related matters.

Identifying efficiency opportunities and compliance risks through systematic process reviews.

Leveraging audit findings and historical data to refine and strengthen internal tax processes.

Skills, Qualifications, and Experience Required:

Bachelor’s degree or above (Taxation, Accounting, or Finance preferred)

At least 3-5 years of relevant professional experience in taxation.

Excellent command of English, both verbally and in writing, knowledge of any other European languages or Chinese is a plus

Demonstrate excellent analytical skills, precise and able to multi-task effectively

Proactive, diligent, team player and also be able to work independently

Chartered Tax Advisor license is an advantage.

Experience with SAP is a plus.

Familiarity with direct tax compliance and/or professional experience within the manufacturing (especially the automotive) sector is highly regarded.

What we offer

International work environment;

Collaborate with a diverse team of professionals from around the world.

A supportive and inclusive work culture.

You can use your English language skills on a daily basis.

Opportunities for career growth and development;

Career opportunities in electric vehicles: Be part of the innovative and rapidly growing electric vehicle industry.

Cross-national training: Participate in training sessions across various countries, gaining valuable global insights.

Multilingual training: Enhance your language skills with our comprehensive training programs.

Competitive salary and benefits.

If you align with our mission and have the skills we need, apply to be our Tax Specialist in Hungary today. Join us in our journey towards a sustainable future!

Location: Hungary, Budapest

Type of Employment: Full-time

- Department

- Finance

- Locations

- Budapest

Budapest

About BYD Europe

As the first overseas subsidiary of BYD group, our main focus is to provide European customers with new energy vehicles, rechargeable batteries, solar panels, energy storage systems and other new energy products, as well as related after-sales services.

Already working at BYD Europe?

Let’s recruit together and find your next colleague.